Ozon generates a sales report for the month and sends it to you by the 5th day of the following month.

You can download a sales report in your account in the Finances → Documents → Sales reports section.

Report structure

“Sold” section

Contains information about the products delivered to customers during the reporting period.

- Sold for the amount is the cost of all sold products, including regional coefficients. It’s calculated based on the selling price.

- Sold for the amount is the cost of all sold products. It’s calculated based on the selling price.

- Points for discounts is the number of points that we accrue to you for discounts given during the reporting period. You can use them to cover your commission fees.

Learn more about points for discounts

- Quantity is the quantity of products sold at the selling price.

- Selling price is the price that the customer paid for the product.

- Sales fee by category (for reference) is the fee rate for the product of this category.

- Price before discounts at the Seller’s initiative (for reference) is the price that you’ve set for a product, including promotions.

- Standard commission fee is the fee amount in the contract currency, taking into account the quantity of products, your promotions, and markups.

- Total accrual amount is the amount you’ll receive for sold products after deducting the sales fee.

The commission fee rate is fixed at the moment the order is created. For example, if the product category had a 5% fee rate at the time of order, and 10% when it got delivered, the fee for the product will be 5%.

“Returned” section

Contains information about products that were returned by customers. For example, if the product didn’t fit in size or color.

- Returned for the amount is the cost of all returned products, including regional coefficients. It’s calculated based on the selling price.

- Returned for the amount is the cost of all returned products. It’s calculated based on the selling price.

- Points for discounts is the number of points that Ozon will deduct if the customer returns the product. You’ll only be charged for the return of products that Ozon has accrued points for.

Learn more about points for discounts

- Quantity is the quantity of the returned products.

- Selling price is the price that the customer paid for the product.

- Standard commission fee is the fee amount in the contract currency, taking into account the quantity of products, your promotions, and markups.

- Total returned amount is the amount you’ll receive for returned products before deducting the sales fee.

If the customer canceled the order or didn’t buy the product, there’ll be no accruals and deductions for shipments. The report doesn’t include cancellations and non-purchases.

Final calculations

The bottom of the table shows final payments including accruals, points, and fees:

- Total accrual = Total accrual amount − Total returned amount.

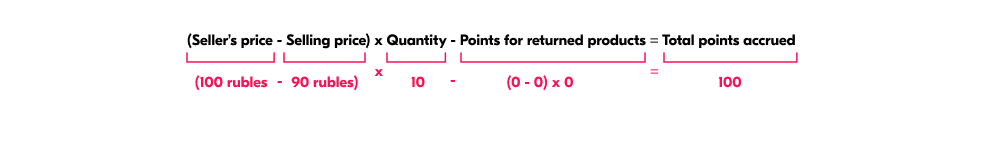

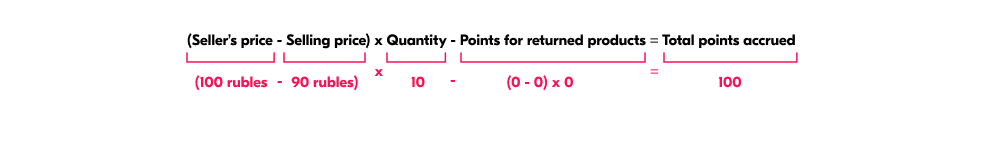

- Total points accrued = Points for discounts (the “Sold” section) − Points for discounts (the “Returned” section).

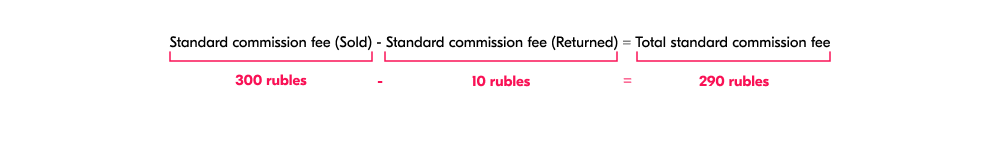

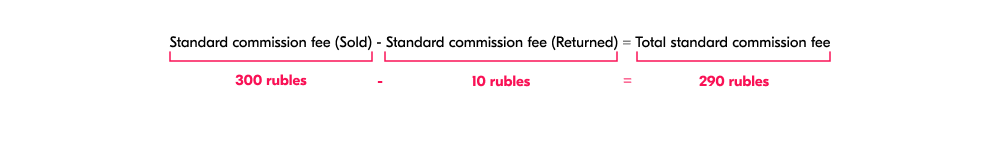

- Total standard commission fee = Standard commission fee (the “Sold” section) − Standard commission fee (the “Returned” section).

- Total fee after discounts applied = Total standard commission fee − Total points accrued.

“Sold” section

Contains information about the products delivered to customers during the reporting period.

- Sold for the amount is the cost of all products sold, taking into account regional coefficients. Calculated based on the selling price.

- Sold for the amount is the cost of all sold products. Calculated based on the selling price.

- Ozon additional payment is the discount at Ozon expense for product promotion on the site.

- Quantity is the product quantity sold at the selling price.

- Selling price is the price at which the customer purchased the product. Can be given taking into account a discount at Ozon’s expense, an installment fee or customer’s points.

- Sales fee by category (for reference) is the commission fee rate for the product by category.

- Seller’s price including seller’s discount (for reference) is the product price, taking into account all seller’s discounts and promotions.

- Total fee including discounts and markups is the commission fee amount in RUB taking into account the quantity of products, discounts provided, and established markups.

- Ozon remuneration is the amount that Ozon will receive from the product sale. It’s calculated as the difference between the “Total fee including discounts and markups” and “Ozon additional payment” values.

- Total accrual amount is the amount accrued to the seller for the returned products before deducting the commission fee, applying discounts, and established markups.

The commission fee rate is fixed at the moment the order is created. For example, if a commission fee rate for the product category is 5% at the time of ordering but 10% at the time of delivery, the commission fee for the product will be 5%.

“Returned” section

Contains information about products that were returned by customers in the previous month. For example, if the product didn’t fit in size or color.

- Returned for the amount is the cost of all products sold, taking into account regional coefficients. Calculated based on the selling price.

- Returned for the amount is the cost of all returned products. It’s calculated based on the selling price.

- Ozon additional payment discount at the Ozon expense to promote the product on the site.

- Quantity is the quantity of the returned products.

- Selling price is the price at which the customer purchased the product. Can be given taking into account a discount at Ozon’s expense, an installment fee or customer’s points.

- Total fee including discounts and markups is the previously charged commission amount, taking into account the products amount, provided discounts, and set markups.

- Total refunded is the amount accrued to the seller for the returned products before charging the commission fee, applying discounts and established markups.

If the customer returns the product, Ozon will refund you 100% of the commission fee for the sale and deduct the balance payment at the expense of Ozon.

If the customer cancels the order or doesn’t buy it, there won’t be shipment charges and withdrawals. Canceled and non-purchased orders aren’t taken into account in the sales report.

“Total accrual” field

Displays the total payment you’ll receive, not including packaging, processing, pipeline, and last mile services. It’s calculated according to the formula:

Total accrual = Sold in the amount of (“Sold” column) – Total fee including discounts and markups (“Sold” section) + Ozon additional payment (“Sold” section) – Returned for the amount of (“Returned” section) + Total fee including discounts and markups (“Returned” section) – Ozon additional payment (“Returned” section).

How to calculate the payment when selling discounted and marked up products

Sale with a discount for points

Calculation example in RUB

-

On the first day of the month, you set the price of 100 RUB for a product.

-

Ozon added a discount for points to the price from the 10th day of the month.

-

Customers bought 30 products in a month:

- 20 products for 100 RUB each from the 1st to the 10th day;

- 10 products for 90 RUB each from the 10th day to the end of the month.

-

One product without a discount was returned.

-

The sales fee by category is 10%.

To calculate your expected income, Ozon deducts the category fee from your price:

-

sold products: 30 products × (100 RUB - (0.1 × 100 RUB)) = 2,700 RUB;

-

returned products: 1 product × (100 RUB - (0.1 × 100 RUB)) = 90 RUB;

Ozon then compares your price and the selling price. If the selling price is:

- higher than your price, we’ll reduce the fee by the amount of our discount;

- lower than your price, we’ll return the difference with points, which we’ll use to pay for the sales fee in the same month.

The total payment is calculated according to the formula:

Ozon will also accrue points for 10 products sold at a discount (90 RUB each). Since the discount was 10 RUB from each product, the number of points is calculated according to the formula:

Customers bought 30 products, one product was returned. The standard fee is calculated according to the formula:

The payable fee includes the points that cover part of the cost. The payable fee including discounts is calculated according to the formula:

In total, products were sold for 2,800 RUB including returns. Ozon deducted 190 RUB in fees instead of 290 RUB. You’ll receive 2,610 RUB.

Partner loyalty mechanics report

The report details information from the “Payouts for partner loyalty mechanics” column in the Sold and Return sections. It contains the data on the “Green Price” loyalty program.

The data in the “Star products” row is irrelevant for non-CIS sellers.

The report is available in the Finance → Documents → Analytical reports section.

We generate the document within the first 5 business days of the month, but no later than the 8th calendar day of the month.

Report structure

| Column name |

Meaning |

| Partner loyalty program |

Program name. |

| Partner name |

The name of the partner who pays sellers for products under the loyalty program. |

| Partner TIN |

Partner Taxpayer Identification Number (INN). |

| To be accrued, USD |

Amount of the “Payouts for partner loyalty mechanics, USD” columnin the Sold section. |

| To be returned, USD |

Amount of the “Payouts for partner loyalty mechanics, USD” columnin the Return section. |

| Total, USD |

The difference between the “To be accrued, USD” and “To be returned, USD” amounts. |

Selling at a markup

Sometimes a product can be sold for a higher price than the one you’ve set. For example, due to a regional coefficient or if the product was bought in installments. Your total payment amount doesn’t change in any of these cases.

Example

- You’ve set the price of 100 RUB for the product.

- A customer ordered it from another region and paid 105 RUB, including the coefficient.

- The sales fee by category is 10%.

The total payment is calculated according to the formula:

Considering all the tax and legal nuances, we:

- look at your price and the selling price including the regional coefficient;

- calculate the fee including the mark-up: (0.1 × 100 RUB) + 5 RUB;

- make sure the customer hasn’t returned the product.

The product sales report is accompanied by the UTD. The UTD confirms that Ozon has provided the services of the committee and paid VAT from the amount received. In the UTD, Ozon issues a remuneration invoice. This document confirms the fact of the work performed. You’ll need it for a VAT deduction.

Download report example:

Sales_report_from_1.10.2023_(XLSX)

Learn more